Tax depreciation calculator laptop

The number of years that the company will use the asset for the business. For laptops this is typically two years and for desktops typically four years.

Top 3 Online Depreciation Calculator To Calculate Depreciation

TurboTax Premier CDDownload software makes tax filing easy.

. Self-Employed defined as a return with a Schedule CC-EZ tax form. Self-Employed defined as a return with a Schedule CC-EZ tax form. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

If you own rental real estate you should be aware of your federal tax responsibilities. Passive Income Loss Rule. Americas 1 tax preparation provider.

To get a better sense of how this type of depreciation works you can play around with this double-declining calculator. Depreciation on laptop as per companies act 2013 is 6316 under WDV. Our deduction finder helps you discover over 350 tax deductions and credits to get you the biggest tax refund.

19 of CGST Act Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax. 1 online tax filing solution for self-employed. In many cases the salvage value is zero.

When you rent property to others you must report the rent as income on your taxes. The dollar amount that the company can sell the asset for at the end of its useful life. Where the cost is more than 300 then the depreciation formula must be used to calculate the percentage tax deductible amount.

1 online tax filing solution for self-employed. Sum-of-the-years-digits SYD depreciation is another method that lets you depreciate more of an assets cost in the early years of its useful life and less in the. TurboTax Deluxe Online tax software is the easy way to prepare your tax return and maximize tax deductions.

Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of. Americas 1 tax preparation provider. This lets us find the most appropriate writer for any type of assignment.

He writes from home so he can claim some household expenses eg a portion of his rent insurance power home office expenses and depreciation on items like his laptop and office furniture. For tax years prior to 2018 you can deduct only 50 percent of your allowable meals and entertainment expenses. Americas 1 tax preparation provider.

Self-employed people end up having to pay both sides of FICA taxes at 153 of total income. This calculator shows two calculations of Income Tax one is Tax on the basis of the receipt of salaryarrears and the other is Tax on the due basis of relevant years and if the tax on receipt basis is more than due relevant years basis then relief under section 891 will be available otherwise nothing is available means no benefit in distributing the arrears in. If you havent done so already consider using a tax calculator to make sure everything is accurate.

The cost is less than 300. For the 2021 tax year that rate is. You can recover some or all of your improvements by using Form 4562 to report depreciation beginning in the year your rental property is first.

1 online tax filing solution for self-employed. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 1 online tax filing solution for self-employed.

But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Get 247 customer support help when you place a homework help service order with us.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Self-Employed defined as a return with a Schedule CC-EZ tax form. Sum-of-the-years-digits depreciation What it is.

Many expenses can be deducted in the year you spend the money but depreciation is different. Beginning in 2018 generally only meals are 50 percent deductible while entertainment is not deductible at all. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Your tax professional can help you work out the rate of depreciation you can claim over the life of the asset. Laptop or the TurboTax mobile app. If your computer cost more than 300 you can claim the depreciation over the life of the equipment.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Must-read CXO coverage 2022 tech conferences and events to add to your calendar. But the Tax Cuts and Jobs Act of 2017 ended up leaving landlords and their rental income free from any FICA taxes.

There are 4 pre-conditions on the under-300 full claim allowance. Raja I have used capital gain calculator by simple tax India on my 14 years old house in my home town sold for Rs3000000- purchase for Rs 1716092- in 2005. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

You may use the depreciation calculator to calculate the depreciation amount. Self-Employed defined as a return with a Schedule CC-EZ tax form. 1 online tax filing solution for self-employed.

Get guidance and support with employee stock plans rental properties. You can deduct the actual expenses of operating the vehicle including gasoline oil insurance car registration repairs maintenance and depreciation or lease payments. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Tax filing season always begins in September after the tax year finishes 2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund. Lets take the example of a laptop with the initial value of 3000 expected final residual value 1000 and life span of 4 years. Govt valuation is Rs 1993200-.

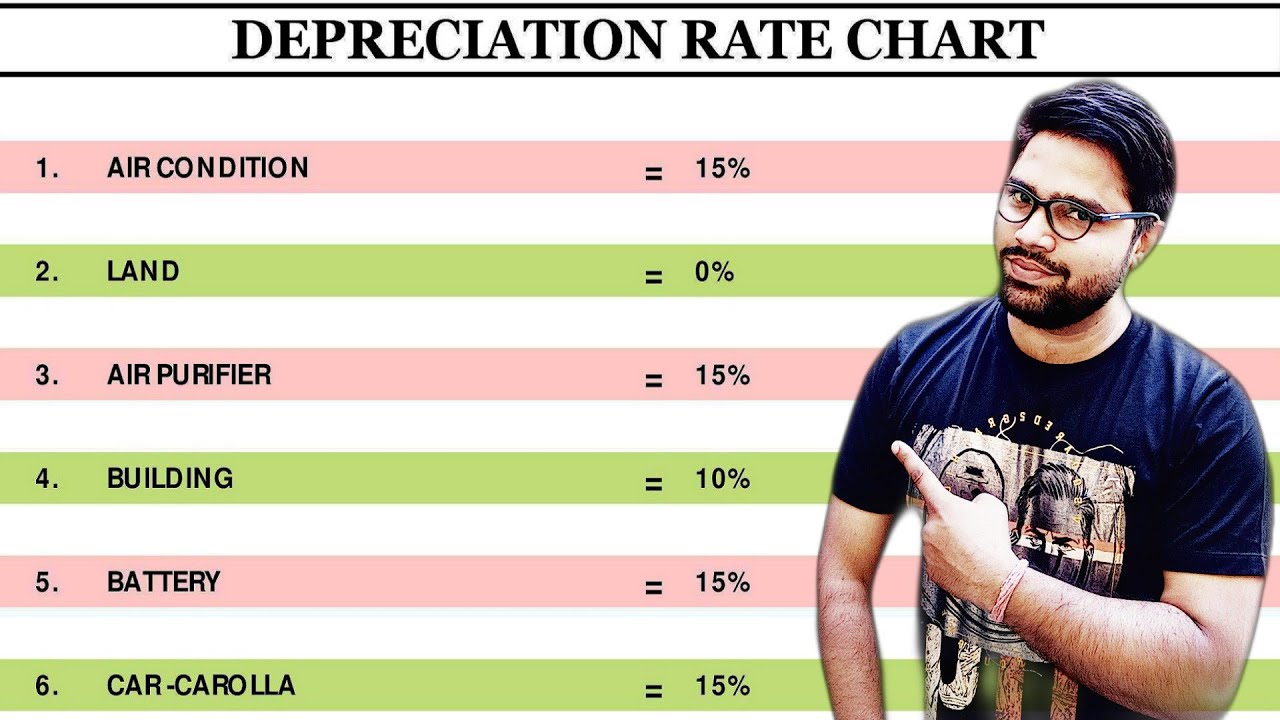

All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Report all rental income on your tax return and deduct the associated expenses from your rental income. Expected rate of depreciation is considered as 15 annually here.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. As a ride-sharing driver and delivery driver he can claim deductions on his vehicle eg petrol work-related parking expenses vehicle repairs. There are several depreciation factors a business can use to determine the reduced value of an asset.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Or you can use the standard IRS mileage deduction. For tax years 2021 and 2022 there is an exception for qualified business meals provided by a restaurant.

Americas 1 tax preparation provider. Americas 1 tax preparation provider. Depreciation allows businesses to express the results of their financial transactions more fairly and accurately.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Step one - Calculate the depreciation charge by using below given formula. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. It calculates investment rental property tax deductions to maximize your tax refund.

Home Office Deduction Calculator

The Best Method Of Calculating Tax Depreciation Koste Chartered Quantity Surveyors

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

726 261 Calculating Images Stock Photos Vectors Shutterstock

How Does Depreciation Of Assets Work For Freelancers And Consultants Tax Hacks

What Is Macrs Depreciation Calculations And Example

How To Calculate Depreciation Legalzoom

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Tax Breaks And Your Rental Property Property Management

How To Calculate Depreciation Know Your Assets Real Value

Engineering Based Tax Solutions For Real Estate Cpa Firms Nationwide

Asset Depreciation Getting The Most Back On Your Tax Return

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator With Formula Nerd Counter